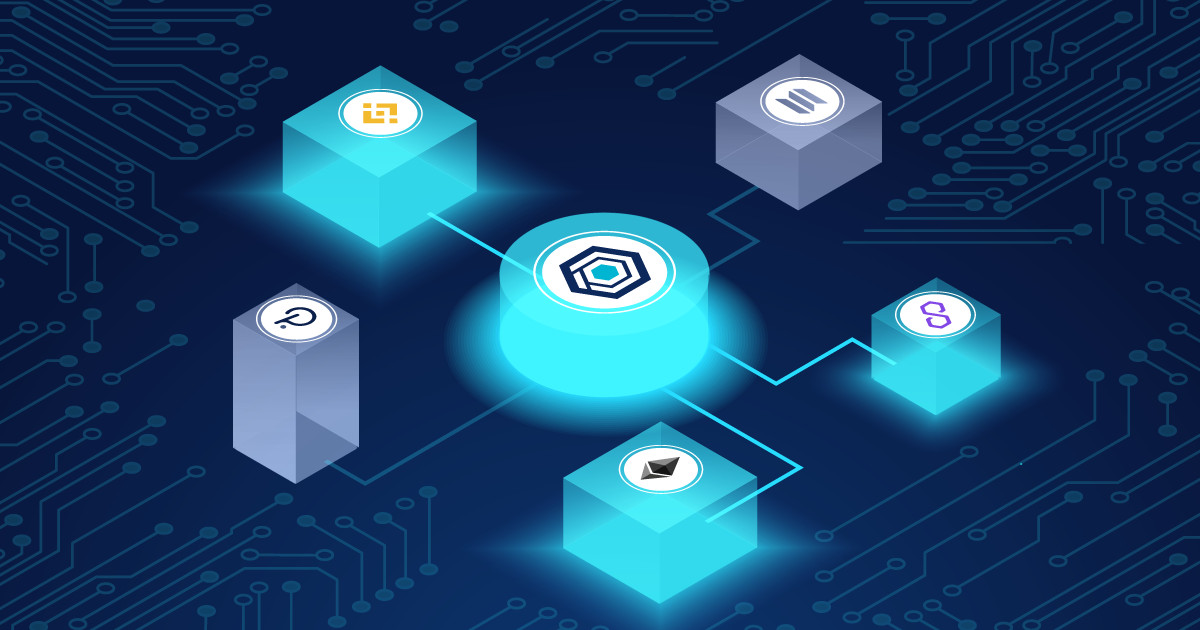

Cross-chain smart contracts are decentralized applications made up of multiple smart contracts distributed across multiple blockchain networks. They interoperate to create one unified application.

This new design paradigm is an important step in the evolution and growth of the multi-chain ecosystem. It has the potential for creating entirely new smart contract use cases that take advantage of the unique advantages of different blockchains, layer-2 networks, and sidechains. You can find companies like rampdefi, which provides a cross-chain liquidity transfers platform.

This article explores the multi-chain ecosystem's rise, outlines the challenges and benefits of multi-chain smart contract strategies, and explains how cross-chain smart transactions represent a paradigm shift in the way blockchain-based decentralized apps are created.

The cross-chain Interoperability Protocol can facilitate this transition by enabling cross-chain secure communication between blockchains.

The Ethereum main net is the first blockchain network that supports fully-programmable smart contracts. This has been the case for smart contract adoption. In addition to its first-mover advantage and its decentralized architecture, the growing network effect, time-tested tools, and a large Solidity developer community have all contributed to Ethereum's adoption.

As Ethereum's block space (computing resource) is in high demand, there has been an increase in network transaction costs. Although the Ethereum main net is still one of the most secure networks to execute smart contracts, many end-users are now looking for lower-cost alternatives.

To meet developers' and users' needs, smart contracts have been rapidly adopted on alternate layer-1 and sidechain blockchains. The multi-chain ecosystem was once a theoretical concept. This is evident in the diversification of DeFi's Total Value across different on-chain environments.

The multi-chain ecosystem's growth is also evident in other metrics such as transaction count, daily active addresses, and network bandwidth usage.